Mastering Business Finance: The Key to Unlocking Sustainable Growth

Understanding business finance is not just for accountants or financial analysts; it’s a critical skill for every business owner, particularly those running SMEs. Navigating the world of numbers might seem overwhelming, but with the right mindset and tools, financial knowledge becomes a powerful asset that drives sustainable growth.

In today’s competitive landscape, a strong grasp of financial principles is essential for any company looking to thrive. Whether managing cash flow, analysing profit margins, or planning investments, financial literacy equips you with the insights needed to make informed decisions. Let’s explore why understanding business finance is crucial and how it can transform your operations.

The Power of Financial Literacy

Financial literacy is more than just a buzzword; it’s a foundational skill for business owners and leaders. By understanding key financial principles, you gain the ability to interpret balance sheets, income statements, and cash flow reports, leading to better budgeting practices and resource allocation.

Mastering business finance enables you to:

- Make Informed Decisions: A solid grasp of your company’s financial health allows you to make data-driven decisions, ensuring that every investment, expansion, or operational change aligns with your financial goals.

- Allocate Resources Effectively: Understanding your finances helps you allocate resources efficiently, prioritize initiatives, and identify areas for cost optimization, maximizing your return on investment (ROI).

- Manage Risks Proactively: Financial acumen allows you to anticipate and mitigate potential risks, such as economic downturns or unexpected expenses. With a clear understanding of your financial position, you can develop strategies to safeguard your business.

- Increase Investor Confidence: Demonstrating a strong grasp of your financial health and growth potential increases investor confidence, attracting the funding and partnerships necessary for expansion.

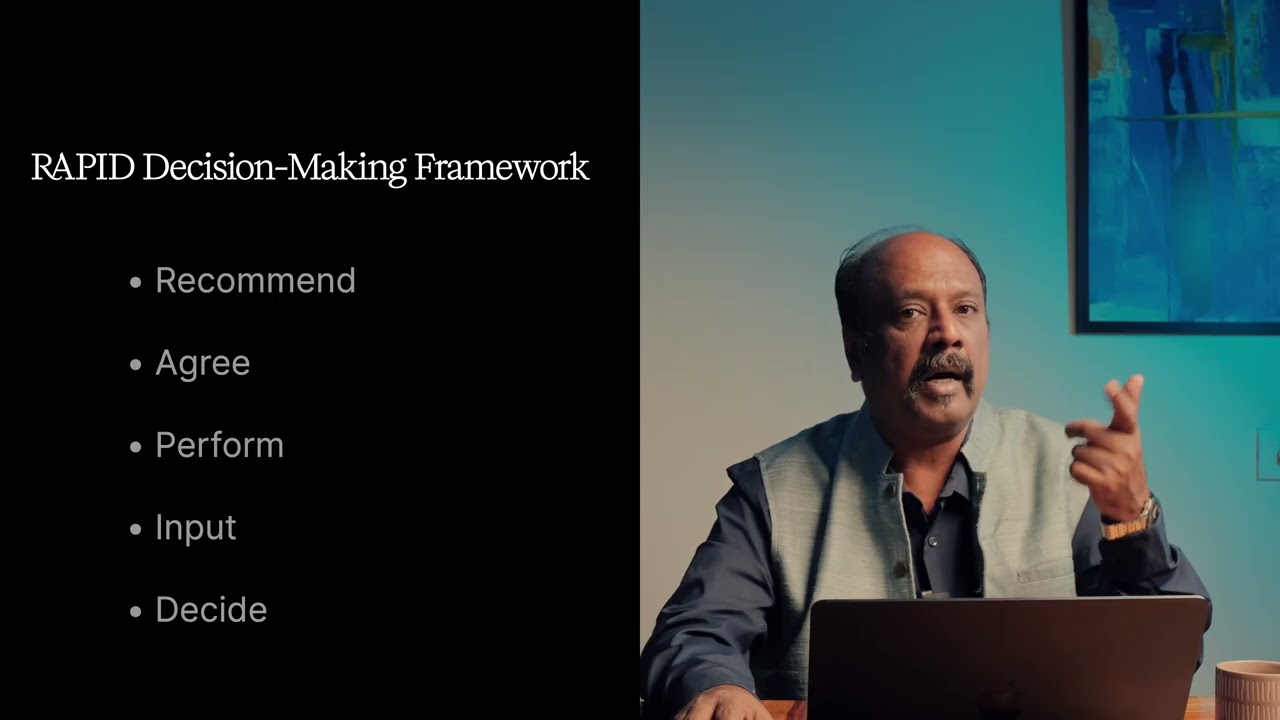

Leveraging Financial Frameworks and Strategies

To effectively navigate business finance, various frameworks and strategies have been developed. These tools provide structured approaches to managing money and making informed decisions. Two key frameworks are the Balanced Scorecard and the Financial Lifecycle Model.

The Balanced Scorecard is a strategic management framework that aligns business activities with vision and strategy. By considering financial, customer, internal processes, and learning perspectives, it offers a comprehensive view of performance. For business owners, the Balanced Scorecard helps align financial goals with operational objectives, identify key performance indicators (KPIs), and enhance transparency.

The Financial Lifecycle Model outlines the stages a business goes through, from inception to maturity. Understanding these stages allows business owners to tailor strategies for managing cash flow, financing needs, and overall financial health. The key stages include:

- Start-up: Securing funding and establishing financial controls.

- Growth: Managing working capital and accessing growth capital.

- Maturity: Optimizing financial processes and exploring diversification.

- Renewal or Exit: Preparing for business transition, whether through a partnership, acquisition, or succession planning.

By aligning financial strategies with the appropriate lifecycle stage, business owners can make informed decisions and position their organizations for long-term success.

Embracing a Financial Mindset for Sustainable Growth

In today’s dynamic business environment, embracing a financial mindset is essential for sustainable growth. Understanding finance as a strategic tool for innovation allows business owners to navigate uncertainties and seize opportunities. A strong financial foundation empowers businesses to explore expansion and fosters accountability among team members, aligning everyone towards common goals.

By integrating financial considerations into every aspect of your business, you unlock opportunities for growth and profitability, ensuring your business not only survives but thrives in a competitive landscape.

FAQ

What is business finance and why is it important?

Business finance refers to managing a company’s money — including capital, revenues, expenses, and investments — and why business finance matters is because it underpins every decision, from daily operations to long-term strategic planning. Without solid finance management, even good ideas may fail due to cash flow issues or misallocation of funds.

How does business finance support growth?

By applying understanding business finance basics, a firm can allocate resources effectively, scale operations, and invest in growth opportunities while keeping risk under control. This financial insight allows businesses to plan expansions, optimize returns, and unlock sustainable growth.

Why should entrepreneurs understand finance basics?

Entrepreneurs who grasp importance of financial literacy for business are better at interpreting financial statements, managing cash flow, and making data-driven choices. This foundational knowledge prevents bad decisions, supports sound budgeting, and gives them confidence when negotiating with investors or lenders.

What are the key elements of business finance?

Key elements of business finance include cash flow management, budgeting, financial reporting (balance sheets, income statements), and risk assessment — all part of understanding business finance basics. These components form the toolkit that ensures a company remains solvent, compliant, and positioned for growth.

How does financial literacy improve decision-making?

The importance of financial literacy for business shines in better decisions: when business owners understand profits vs costs, can forecast outcomes, assess investments, and mitigate risks. This literacy transforms guesswork into informed strategy, improving performance, resilience, and stakeholder confidence.